The Australian Government’s Financial Claims Scheme (FCS) protects your deposits with Bank Australia up to a capped amount.

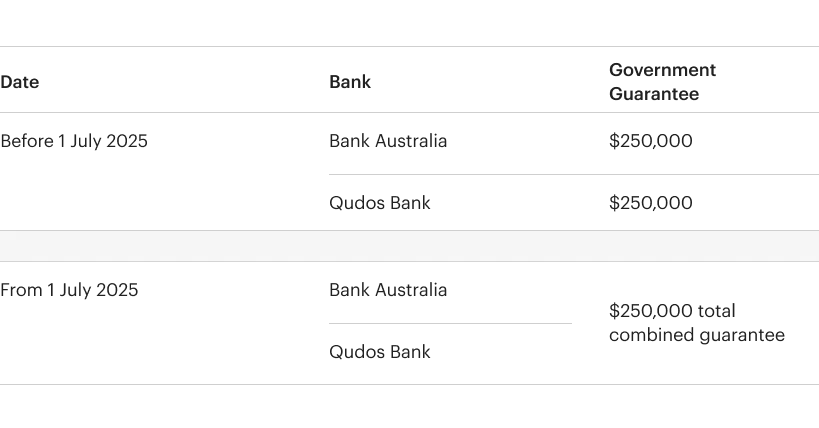

From 1 July 2025, the merger between Bank Australia and Qudos Bank means that all deposits held by Bank Australia and Qudos Bank will be treated as a single combined balance under the FCS.

This means that if you currently have more than $250,000 in total deposits across both banks, you will no longer have two separate $250,000 government guarantees. Instead, only one $250,000 guarantee will apply to your combined balance.

We meet the same strict standards as all Australian banks which are set out in the Banking Act 1959 and overseen by the Australian Prudential Regulation Authority (APRA). APRA’s rules on safety and capital that apply to banks apply to Bank Australia.

Deposits with Bank Australia are protected under the Australian Government’s Financial Claims Scheme (FCS).

What is the Financial Claims Scheme (the deposit guarantee)?

The Financial Claims Scheme (FCS) is an Australian Government scheme that provides some protection and quick access to deposits in banks, building societies and credit unions in the unlikely event that one of these financial institutions fails.

Under the FCS, certain deposits are protected up to a limit of $250,000 for each account holder at any bank, building society, credit union or other authorised deposit-taking institution (ADI) that is incorporated in Australia and authorised by the Australian Prudential Regulation Authority (APRA).

The FCS can only come into effect if it is activated by the Australian Government when an institution fails. Once activated, the FCS will be administered by the Australian Prudential Regulation Authority (APRA).

In an FCS scenario, APRA would aim to pay the majority of customers their protected deposits under the Scheme within seven calendar days.

How is the FCS limit applied?

The FCS limit of $250,000 applies to the sum of an account holder's deposits under the one banking license.

Therefore, all deposits held by an account holder with a single banking institution must be added together towards the $250,000 FCS limit, and this includes accounts with any other banking businesses that the licenced banking institution may operate under a different trading name.

Where can I get further information on the FCS?

Information on the FCS is available on the FCS website at www.fcs.gov.au

Our reports

Our annual Financial Reports shares the details on all elements of our financial position.

Banking Codes of Practice

We're a member of both the Australian Banking Association's Banking Code of Practice and the Customer Owned Banking Association's Banking Code of Practice, and therefore are committed to best practice standards that protect our customers.